Rainbow Six Siege to Have New Take on DLC

11/05/2015Rainbow Six Siege's new DLC will feature a unique approach to content updates, according to recent announcements.![One Last Shot at Fallout 4 Pip-Boy Edition [Update: Out of Stock] 1](https://cdn.cgmagonline.com/wp-content/uploads/2015/10/fallout-1280x720.jpg)

Fallout 4 Releases Companion App Six Days Early

11/05/2015Fallout 4's companion app has been released six days ahead of the game's launch, offering players a range of features.

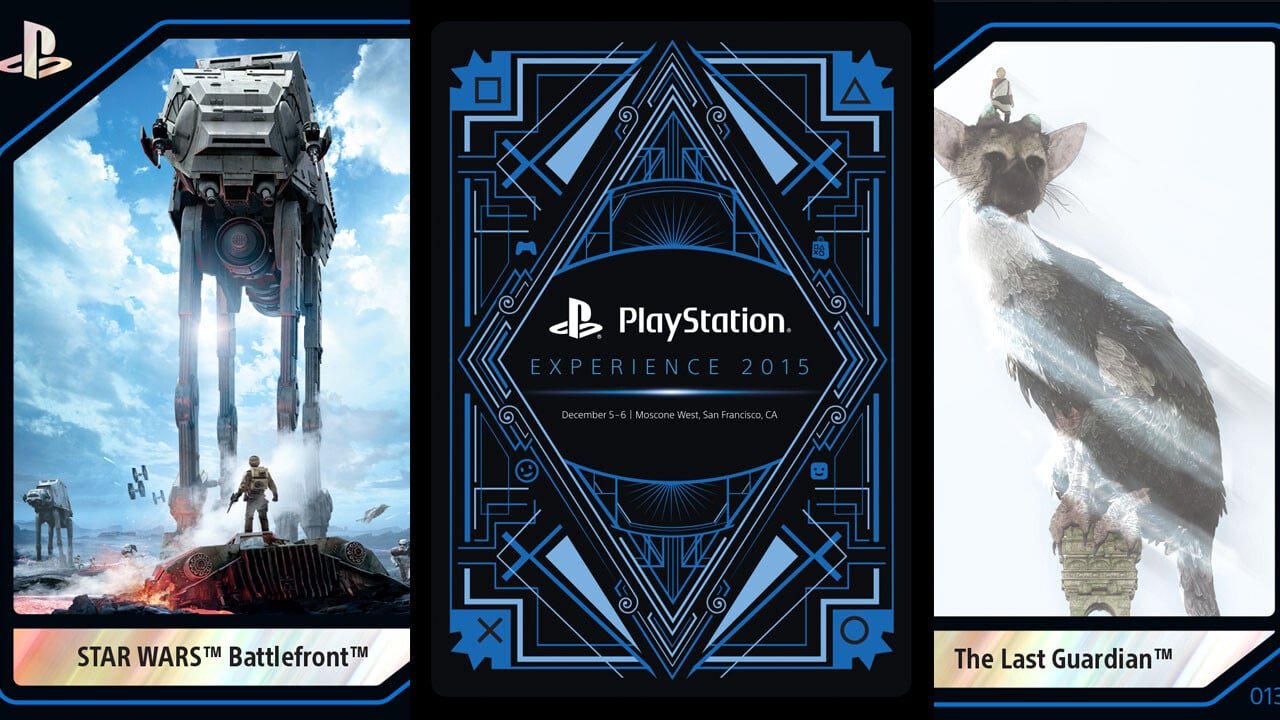

Introducing PlayStation Collectible Cards

11/05/2015Introducing PlayStation Collectible Cards - a new way for fans to collect and showcase their love for PlayStation.

New Details Emerge For The Witcher Film Adaptation

11/05/2015New details revealed for The Witcher film adaptation, including a prequel story and a focus on Geralt's mentor, Vesemir.

PlayStation 4 Hits Gaming Milestone

11/05/2015The PlayStation 4 has sold over 100 million units, making it one of the best-selling consoles of all time.

New PlayStaion 4 Ad Campaign Just Launched

11/05/2015Sony's new PlayStation 4 ad campaign has been launched, featuring a variety of games and emphasizing the console's versatility.

New Survey Shows More Women Own Consoles then Men

11/05/2015New survey reveals that more women own gaming consoles than men, challenging the stereotype of gaming being a male-dominated hobby.

New Summon Night 6 Screenshots Released

11/05/2015Check out the latest screenshots from Summon Night 6, the upcoming RPG game with a unique battle system and engaging…