In a highly competitive bidding war over ownership of Warner Bros., Netflix seems to be the victor, outbidding the likes of Paramount Skydance, and Comcast.

Announced by Netflix on Friday, the deal involves both cash and stock and values at $27.75 per share. That means the overall value is roughly $72 billion. It’s a fairly aggressive move on Netflix’s part, which blocks out three consecutive offers by Paramount earlier.

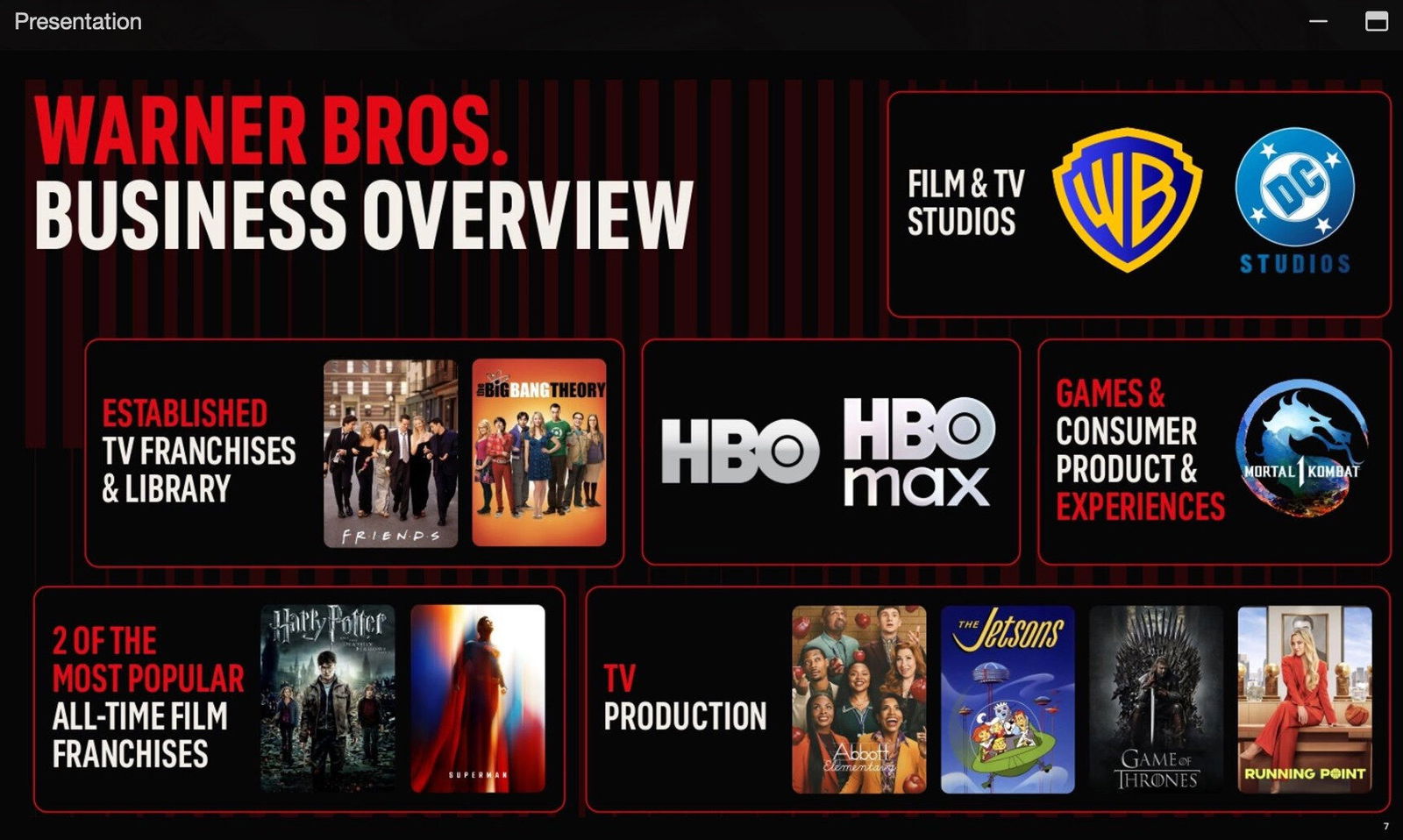

Netflix will acquire Warner Bros.’ film studio and streaming service HBO Max. This, of course, includes DC Studios and properties like Superman, Harry Potter, Friends, and production on Game of Thrones. Game Developer also confirmed the deal includes Warner Bros. Games, including Mortal Kombat. The slide below was shown during a Netflix conference call discussing the deal, shared by Game Developer reporter Chris Kerr on Bluesky.

“This acquisition will improve our offering and accelerate our business for decades to come,” said Netflix co-CEO, Greg Peters, in a press release. “Warner Bros. has helped define entertainment for more than a century and continues to do so with phenomenal creative executives and production capabilities. With our global reach and proven business model, we can introduce a broader audience to the worlds they create—giving our members more options, attracting more fans to our best-in-class streaming service, strengthening the entire entertainment industry and creating more value for shareholders.”

According to CNN, “Warner Bros. Discovery (WBD) said it is moving forward with its plans to split into two publicly traded halves in 2026. Once the split takes effect, Netflix intends to acquire the Warner half. The other half, Discovery Global, will house CNN and other cable channels.”

The deal is expected to go through once the TV networks’ separation takes place, which is estimated to be in the third quarter of 2026. So the overall acquisition should happen in 12-18 months. Both Netflix and Warner Bros. have said their board of directors unanimously approve of the deal, and it’s also subject to regulatory approval and shareholder approval. On top of that, Netflix has agreed to pay a $5.8 billion reverse break-up fee if, ultimately, the deal isn’t approved. Warner Bros. would pay a $2.8 billion break-up fee if they pursue a different merger.

Paramount has been vocally against the Netflix buyout. As reported by Deadline, sending a letter from its legal counsel directly to Warner, saying “Netflix’s dominance in streaming and Comcast’s presence as a leading broadband and MVPD player each present unique and serious antitrust concerns that guarantee a long, expensive review process and imperil closing either deal. Paramount is the easier path, and its outcome is assured.”